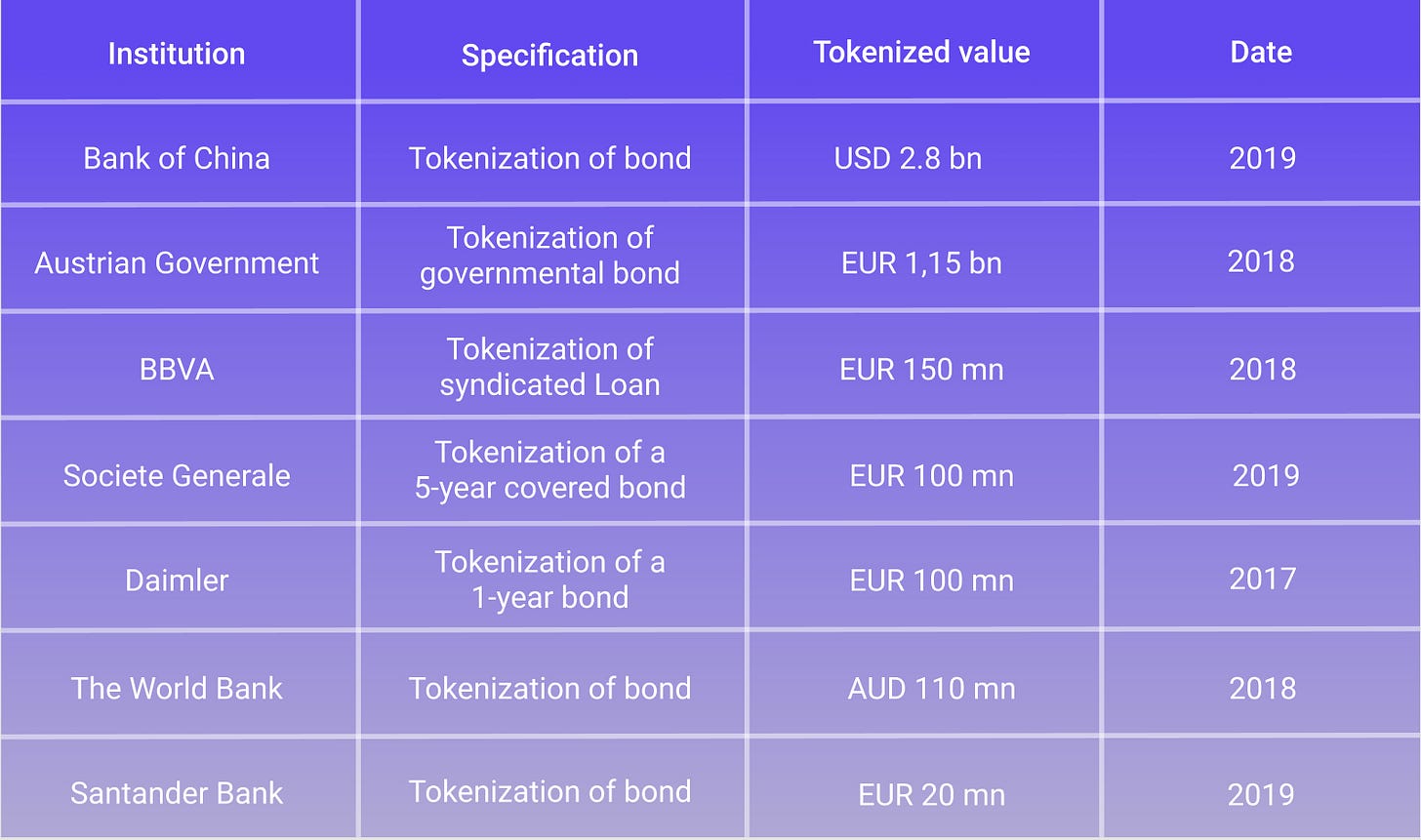

TOP 7 LARGEST BOND TOKENIZATIONS

Hi,

This is Maciej Zieliński from Nextrope’s Insights. Today's newsletter is devoted to the most significant tokenization projects in recent years. Tokenization is a relatively young fundraising solution, but its importance in the financial world increases significantly with each passing year. Today, innovative fintech startups are interested in it and the largest banks in the world or real estate tycoons. What were the 8 biggest tokenizations by value?

Specifically, we will discuss projects by:

🇨🇳Bank of China

🇦🇹Government of Austria

🇪🇸BBVA

🌏The World Bank

🇩🇪Daimler

1. BANK OF CHINA - $2.8 BILLION

Although the Chinese government has been critical of digital currency (remember banning cryptocurrencies in 2017?), the recent DCEP initiative from China's government demonstrates a move towards accepting new financial technology, including digital securities. This has led major banks across China to explore blockchain applications.

In 2019, the Bank of China tokenized bonds worth as much as 20 billion yuan ($2.8 billion). Their issuance was part of an initiative to revive the Chinese economy by supporting micro and small enterprises. To date, it is the largest tokenization conducted in history.

Yet, China Construction Bank, the second-largest bank globally, has serious plans to beat it. In November 2020, it announced a partnership with Fusang, a licensed Malaysian digital securities platform. Two companies are going to issue tokenized bonds worth approximately $3. billion.

2. GOVERNMENT BONDS IN AUSTRIA - €1,15 BILLION

In 2018, Austria became the first country in the world to tokenize government bonds. Using the Ethereum blockchain to manage securities' issuance, the Austrian government sold assets worth a total of €1.15 billion.

“This added security contributes to a high level of confidence in the auction process of Austrian government bonds and strengthens Austria’s good standing in the market, which can also indirectly contribute to favorable financing costs.” - said Markus Stix, head of the Federal Government’s Finance Agency (OeBFA).

3. BBVA - €150 MILLION

At the end of 2018, Spanish banking giant BBVA completed a pilot in which it staked a syndicated loan to Red Electric, Spain's national electricity grid operator.

Worth €150 million, the transaction was conducted on a private blockchain network using Hyperledger Fabric technology. Six separate entities participated: Red Eléctrica; three financing banks: BBVA, BNP Paribas, and MUFG; and two legal advisors Linklaters and Herbert Smith Freehills.

Each step of the negotiation was recorded on the DLT (distributed ledger technology) network along with the user's identity and timestamp. By sharing the information on a private blockchain network, all parties could track the progress of the negotiations and their status.

“This transaction is part of our company’s initiative to push digital transformation and innovation as levers for growth and efficiency, enabling us to address the challenges that the changing energy environment represents to our company.” - Tresa Quirós, CFO of Red Eléctrica, said of the arrangement.

4. SOCIETE GENERALE - €100 MILLION

Using blockchain Ethereum, a subsidiary of banking giant Societe Generale SFH, issued a €100 million covered bond in April 2019.

The French banking giant provided comments on the benefits that tokenization can bring to traditional financial securities: “This live transaction explores a more efficient process for bond issuances. Many added value areas are predicted, among which, product scalability and reduced time to market, computer code automation structuring, thus better transparency, faster transferability, and settlement. It proposes a new standard for issuances and secondary market bond trading and reduces cost and the number of intermediaries.”

5. DAIMLER - €100 MILLION

The German automotive giant behind brands like Mercedes-Benz tokenized €100 million worth of corporate annual bonds in 2018.

According to Daimler, the entire transaction cycle - from origination, distribution, allocation, and execution of the loan agreement to the confirmation of repayment and interest payments - was digitally automated through the Blockchain network.

"Blockchain allows information to be managed without a central control unit, unlike conventional issuance where the bank takes on this role. This provides greater transparency and also reduces the administrative burden. Each of the three stages of an issue - preparation, marketing, and implementation - will benefit from digitization." - says Kurt Schäfer, head of treasury at Daimler.

“It was definitely not disappointing.” - add Eva-Marie Scholz, Daimler AG’s senior manager of treasury process management - "Reflecting on the process, we can review the potential of blockchain to make real business model changes for overall capital markets and banking transactions.“

6. WORLD BANK – AUD 110 MILLION

In August 2018, the World Bank launched bond-i, the world's first bond to be created, allocated, transferred, and managed throughout its whole life cycle via Blockchain technology. The two-year bond raised 110 million Australian dollars.

Arunma Oteh, World Bank Treasurer, said: “I am delighted that this pioneer bond transaction using the distributed ledger technology, bond-i, was extremely well received by investors. We are particularly impressed with the breadth of interest from official institutions, fund managers, and banks. We were no doubt successful in moving from concept to reality because these high-quality investors understood the value of leveraging technology for innovation in capital markets.”

7. SANTANDER BANK - €20 MILLION

In 2019, Spanish bank Santander tokenized €20 million worth of bonds in partnership with London-based startup Nivaura. The venture was the culmination of research into the use of Blockchain technology started by the company back in 2016.

“Our clients are increasingly demanding the best thinking and technology in how we serve them in their capital-raising efforts.” - said José María Linares, global head of Santander Corporate & Investment Banking - “This blockchain-issued bond puts Santander at the forefront of capital markets innovation and demonstrates to clients that we are the best partner to support them on their digital journey.”