Hi,

This is Ayaan Shah and I would like to thank all of you for your continued support as we crossed 100 subscribers this week and had over 600 views on the most recent newsletter.

Last week, we learned about the development, limits and the economics of Ethereum 2.0. This week we will narrow the focus on an Ethereum use case - Decentralized Finance (DeFi). DeFi has been the blockchain community’s obsession over the past few months and today we’ll discuss why.

Today we’ll discuss:

❓ What is Decentralized Finance?

📈 Characteristics of Decentralized Finance

🔥 What are the Decentralized Finance use cases and why is it such a hot topic?

❌ Risks and current limitations of Decentralized Finance

If you have any questions, I am happy to answer them, so please don’t hesitate to ask. I greatly appreciate any feedback and will try to incorporate them into my newsletter!

Not financial advice

We have done our best to ensure that the information provided in the Newsletter and the resources available for download are accurate. However, the information contained in this Newsletter and the resources available for download are not intended as, and shall not be understood or construed as financial advice.

What is Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) builds on the opportunities cryptocurrency technology has established. While cryptocurrency is just a decentralized store of value, DeFi is creating decentralized financial instruments to carry out the functions of financial institutions – lending, borrowing, exchanging, investing etc. The ultimate aim is to create an open-source, permission-less, and transparent financial service ecosystem available to everyone via peer-to-peer (P2P) capability which operates without any central authority. All these financial functions are conducted on the back of “Smart Contracts” which specifies all the terms and conditions through code.

But why is an alternative to the current system necessary? What do we have to gain? Traditionally, financial institutions, such as banks and courts, rely on middlemen to function. This creates additional financial burdens through transaction costs, especially because they have a monopoly over who can access their systems.

DeFi applications remove these intermediaries and arbitrators with code that specifies the resolution of every possible dispute. They ultimately allow the users to maintain control over their funds at all times. Axa, an insurance firm, has recently launched its flight delay insurance using an Ethereum smart contract and is a good example of how this system works. The smart contracts are linked to flight and air traffic databases that simply refund a customer when the system notices that there is a two-hour delay in flight time. There is absolutely no human element involved and the validation is immediate. While the idea of decentralizing transactions like these have existed for around a decade, there has been a sudden explosion in its usage, attracting many more users and investors to DeFi.

Source: defipulse

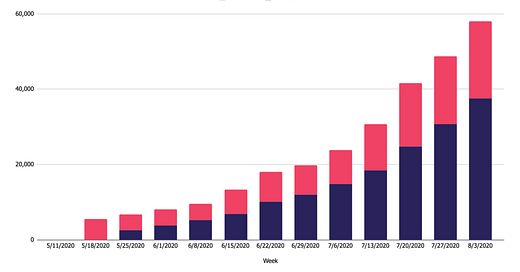

The recent DeFi success is largely attributable to a new concept called “yield farming”. This method allows people to pool money and every time someone borrows from this pool, the contributors earn a fee. Currently, Uniswap is the largest liquidity provider in the DeFi market and has grown substantially in terms of liquidity and users in the past year.

Source: Blockcrypto

Characteristics of DeFi

DeFi premieres a few novel characteristics while also improving on existing functionality:

Tokenization – This process allows users to trade physical assets such as real estate or art onto the blockchain as token and can then be traded across the globe, greatly increasing liquidity. These tokens are also divisible, so investors can purchase tokens that actually represent just a small part of the underlying asset (yes, you might be able to own a small percentage of Mona Lisa one day). If you want to understand this concept better, we have gone into further detail on our blog here.

No intermediaries – As I have mentioned before, traditional financial services require the existence of a trusted third party to act as intermediaries. For DeFi, assets are encoded in smart contracts on the blockchain and no party, other than the user themselves, can control the movement of funds. The code does everything you tell it to, and nothing else.

Borderless – Most DeFi platforms I have come across do not have Know Your Client (KYC) requirements. This means that anyone with access to the internet anywhere across the globe can access these facilities. The philosophy is that the people without access to traditional financial infrastructure (estimated at 1.7 billion people globally) in various parts of the world should be able to join the ecosystem.

Open source & transparent - One of the core philosophies of DeFi is that anyone can audit open source code to test for security vulnerabilities. The public is able to monitor the system at any time, making unnoticed and arbitrary changes difficult to enact. This puts the user in the driver's seat but also means that users are responsible for any accidents. Simply, we cannot pin the blame on a big, evil corporation.

Low overhead - Since all functions are executed by smart contracts, human labor is not necessary for the back-end work. This means that once the system is set up, there can theoretically be no costs associated with the ongoing operation of the service. Note that is just a theory - in reality various platforms do charge a fee, but it is considerably lower than traditional finance.

DeFi Use Cases

I suspect that for those of you who do not have any background knowledge about DeFi, the concept still feels very abstract. Don’t fret, we’ll examine some use cases of DeFi to shine light on its potential.

Decentralized Loans

To date, the biggest sector for decentralized applications has been lending & borrowing crypto assets. Banking 101 teaches us that the bank pays a much lower interest rate to its depositors and charges a much higher interest rate to its borrowers and earns the spread in between. Decentralized Finance looks to narrow this spread significantly by removing the intermediary in between and enabling lending in a peer-to-peer (P2P) manner, benefiting both parties.

At first glance, this new system seems ready to disrupt the centralized loan approach. However, digging one layer deeper reveals a major problem—Defi cannot ensure the return of a loan and interest like the banks can. Banks use the 4 Cs of credit when determining whether to lend: character, capacity, capital and, collateral. However, since most DeFi lending is anonymous, these applications can only employ one of those Cs: collateral. Borrowers are required to provide collateral more than their borrowing amount (normally 150%), which is then locked in a smart contract and liquidated if they are unable to repay the loan. On top of this, borrowers also need to pay an annual interest rate.

Would anyone borrow if they already have more of the asset to give as collateral and then pay an interest on it? The only way the current system is a draw for borrowers is if they are speculating on the price of their collateral itself. For example, if we expect Ether (ETH) price to fall, we would borrow Bitcoin with ETH as collateral and after the price of ETH falls, we would keep the Bitcoin while the lender receives the collateral, whose value has fallen.

Developers have realized that this problem severely limits the use cases of Lending via DeFi and in response Aave, a Defi money market with the highest Total Value Locked (TVL), has recently come up with a solution. Aave’s new protocol allows lenders to delegate their credit to a third party and essentially co-sign a loan to a borrower. The third party then vets the borrowers and takes the ownership of the insolvency risk. While it is natural to think in terms of person-to-person lending here, this system of credit delegation is aimed more at institutional-level use cases and sophisticated, price-conscious trading outfits that need options for fast and easy credit. Essentially, this feature paves the way for a better use of the four Cs of credit and allows for broader use cases than the ones currently available.

Decentralized Crypto Exchange (DEXs)

Decentralized exchanges, similar to decentralized lending, allow P2P trading of cryptocurrencies. They also operate in a similar fashion as Stock trading exchanges, such as the New York Stock Exchange or NASDAQ, but without a central authority.

For any exchange - centralized or decentralized - to be successful, the ‘network effect’ is critical. Network effect can be understood as the additional value that a user brings to a business just by participating. The perfect examples are social networks like Facebook, Instagram or Snapchat where most people join these platforms just because most of their friends use them. The higher the number people trade on DEXs, the better the quality of the overall experience. Without these network effects, traders face high spreads (a large difference between asking and selling price), monopoly by big players who then command a premium over the price, and high volatility. To gauge the ‘network effect’ on Exchanges, we use Traded Volume to understand how many buyers and sellers are participating in the marketplace.

Source: Bravenwcoin

From the data I collected, trading volume on DEXs is up over 1500% in 2020. The Uniswap and Sushiswap DEX projects (41% of volume), aforementioned, are the frontrunners of this growth (This involves a very interesting story, which I will cover in a future newsletter). Although this growth is truly impressive, DEX only comprises 4% of the volume available at Central Exchanges currently and therefore has a long way to go.

Source: BlockCrypto

Payments

Today, payment cards still dominate the facilitation of transactions. I found that payment cards and mobile wallets are expected to constitute 65+% of the global payment volumes soon.

Bitcoin was originally purely a payment system and while other blockchains have since greatly expanded on the capabilities, payments remain a major use-case for blockchains. Many intermediaries (and fees) are skipped in the process described in the picture below and can be sent anywhere across the globe. Blockchain charges a fixed fee instead of a percentage-based fee charged by centralized payment systems and therefore greatly favors large transactions.

Source: Defi

DeFi Drawbacks

While I mentioned some of the drawbacks while discussing the specific use cases of DeFi, there are some general drawbacks as well which are currently restricting growth.

Blockchain Throughput & High Network Fees – As we discussed in the previous newsletter, blockchains are currently unable to handle the transaction load resulting from the sudden upsurge of DeFi, thus resulting in major network delays. Since network usage is also directly correlated with fees, overall user experience is being hindered. On March 12th 2020, during the peak of market volatility, prices for transactions spiked to four times its normal levels, from $1 for a regular transfer to $10 for a more complex interaction.

Source: Coindesk

Limited Liquidity Currently - Despite impressive growth, it must be noted that DeFi is still small (roughly $9.5 billion as of September 2020) compared to the US$275 billion market cap for all cryptocurrencies. Therefore, the capacity to support the liquidity demands of the cryptocurrency market participants is not yet ready.

Security & Smart Contract Risk - In my opinion, the most significant drawback in DeFi is smart contract risk. Instead of centralized custody and servers, participants have to trust that smart contracts do not have any vulnerabilities in the code that put their assets at risk. The most famous attack in blockchain history was in 2016 when one of the original DeFi protocols- the DAO (Decentralized Autonomous Organisation) was attacked and over 3.6 million ETH (worth $72 million at the time) were drained.

There are two opposing camps on this risk:

a) Detractors point towards these hacks as reasons for why DeFi is no better than centralized services.

b) Each attack on DeFi exposes development flaws, reducing the odds that future projects will make similar mistakes.

Regulatory Risk - DeFi operates within areas that traditionally have significant oversight from governments and regulatory bodies around the world who wish to protect unknowing users from scams and high-risk products. Regulators are concerned it will become a haven for individuals who seek to illegally obtain access to financial services. Due to the important role centralized finance plays in each government, DeFi will certainly fall under the scope of global regulators as it grows in scale and starts to disrupt the finance industry.

Conclusion

Whatever your opinion about DeFi based on this newsletter and prior knowledge, it is still something to keep a lookout for as it disrupts the financial industry. While DeFi currently faces many limitations in its structure and mechanism, many of these problems are solvable whereas others are inherent to the concept of decentralized systems and we’ll have to wait and see if the pros are able to outweigh the cons. Additionally, we have to wait and see whether DeFi and CeFi can co-exist and add value to each other, and if yes, how? I hope you are able to give it some thought as well and we can have a fruitful discussion in the future.

We will continue to follow this story and share any new and exciting trends in the fintech industry next week. If you have any questions, feel free to message me at a.shah@nextrope.com. Hope to see you next week!

Dear Ayaan

Good work specially considering your age and experience

Recent judgments in favour bitcoins give us some hope for alternate mechanism, yet centuries old mind set requires decades to change, more so when it comes to finances. Continue digging in, good luck

Prof Javaid Akhter

Very well explained by Ayaan. This is a new concept and will take some time to sink in. Two aspects which beginners will need to know are, firstly, what will be expected returns compared to other models and , secondly, liquidity. How long will it take to get a hold on money invested incase I need it in a crisis?